These loans are sometimes several thousand dollars or considerably less and can be employed to protect an crisis or bridge an cash flow hole. They generally have small repayment phrases of some weeks or months.

A lender could take into account a borrower with a score beneath 670 a large-hazard borrower and will supply bigger interest fees or need a joint applicant to mitigate their danger. A bad-credit loan could be a considerably less high-priced technique to cover unanticipated fees than the usual substantial-curiosity credit card. You may as well make use of a poor-credit loan to create your credit.

Secured loans will also be easier to qualify for with lousy credit due to the fact they demand you to put up collateral, just like a motor vehicle or personal savings account, to address the lender in case you default around the loan. No credit-check loans, like payday loans, are easy to get, Nonetheless they usually come with dangerously high curiosity premiums and limited repayment conditions.

Critique the amortization agenda. Should the loan demands numerous payments, inquire to see the amortization timetable, which can be a table that demonstrates how much of each and every payment goes towards principal and how much to fascination. Not less than part of Each individual payment need to fork out down the loan’s principal.

Difficult credit inquiries usually influence your credit rating for one 12 months but keep on your report for approximately two decades.

It could possibly't damage to inquire. The worst that they can perform is say no. Most lenders will function with you when you let them know in advance that there may very well be a dilemma. Just be sure to Make contact with the lender properly ahead of time of your respective payment date so that there's the perfect time to think of an alternate arrangement. Virtually all lenders would Substantially instead get the job done which has a customer to take care of the personal debt than have it go unpaid.

Kelly is undoubtedly an editorial leader and collaborator with above 13 yrs of encounter generating and optimizing info-driven, reader-targeted digital content material. Just before becoming a member of our crew, Kelly was the cross-niche editor and Branded Content Guide at personal finance and fintech web site Finder.

Easy accessibility to money: If poor credit prevents you from qualifying for a private loan in other places, you should still manage to obtain a no-credit-check loan.

Some on the net lenders think about borrowers with very poor credit — even Those people with credit scores below 600. That may help you qualify, some lenders consider more details, like work position and outstanding debts. Terrible-credit loans have increased premiums, but ordinarily not higher than 36%.

Other apps Enable people borrow additional at one particular time, but a $750 max between paychecks is high in comparison to other comparable apps. EarnIn doesn’t cost necessary fees, but it has optional strategies and fees for identical-working day funding.

Undesirable-credit own loan: You don’t necessarily have to secure a no-credit-check loan to acquire a private loan with bad click here credit. A lot of authentic lenders offer individual loans to borrowers with negative credit, generally in a portion with the interest price provided by payday loan providers.

Quite simply, you are less likely to get your application declined when you use (in the event you've presently prequalified). LendingClub could charge an origination fee between 3% and 6%.

You might also have use of options like adaptable due dates, 24/7 customer service and price savings (like an autopay discount) which will make repayment lots smoother. These benefits might look tiny but can go a long way if you require revenue rapid.

Friends and family. Borrowing from family and friends is usually a practical solution In case you have poor credit. It offers an opportunity to get a loan with much more favorable terms, which include versatile repayment plans, decrease interest costs or no desire charges at all. In the event you go after this selection, ensure the stipulations are apparent.

Ralph Macchio Then & Now!

Ralph Macchio Then & Now! Michael Oliver Then & Now!

Michael Oliver Then & Now! Patrick Renna Then & Now!

Patrick Renna Then & Now! Brandy Then & Now!

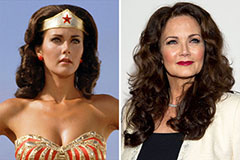

Brandy Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now!